Frequently asked questions

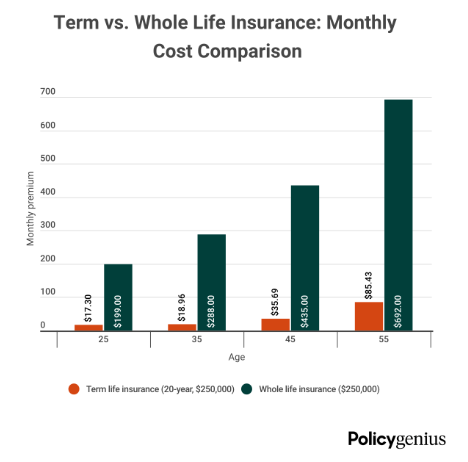

Term life offers affordable coverage for a set period, usually 10 to 30 years. Whole life is a lot costlier because it lasts your entire life and has an investment-like component.

Term life insurance is better for more people because it’s affordable and easy to manage. Whole life insurance is more expensive, but better for people who have a high net worth or long-term dependents.

Term life insurance is cheaper and simpler to manage, but if you need insurance after your coverage expires, a policy may be costly.

Whole life provides permanent coverage, but the policy isn’t cost-effective for most people and the cash value earns low interest.