Frequently asked questions

Homeowners insurance is a form of property insurance that protects your home and personal belongings in the event they’re destroyed by a covered loss, like a fire or windstorm. It can also protect your assets in the event you’re found legally responsible for someone’s injury or damage to their property.

A home insurance quote is an estimate of how much you’ll pay for a policy based on details about your home, credit score, claims history, and coverage limits. All insurance companies have their own way of calculating quotes, so premium estimates can vary widely across insurers.

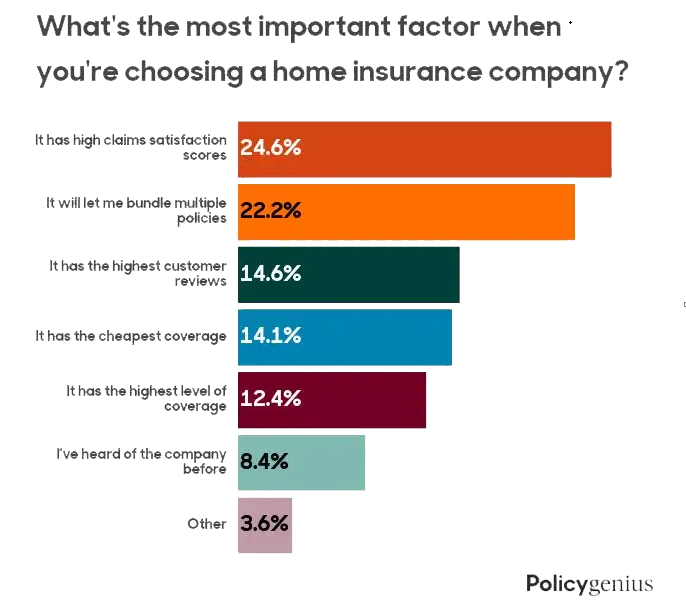

You’ll want to compare quotes to choose the insurer and policy that offers the coverage you need at the most affordable cost. Look for companies that offer discounts, like money off for bundling your home and auto insurance.

Homeowners insurance coverage needs vary from homeowner to homeowner. In general, your coverage amounts should be high enough to cover your home’s rebuild cost (meaning the cost to rebuild it completely if it were destroyed), the monetary value of your personal belongings, and your combined assets. If you need flood or earthquake coverage, you’ll need to buy those separately.

No, homeowners insurance is not required by law in any state. However, most lenders will require proof of home insurance before you can close on a property.