Frequently asked questions

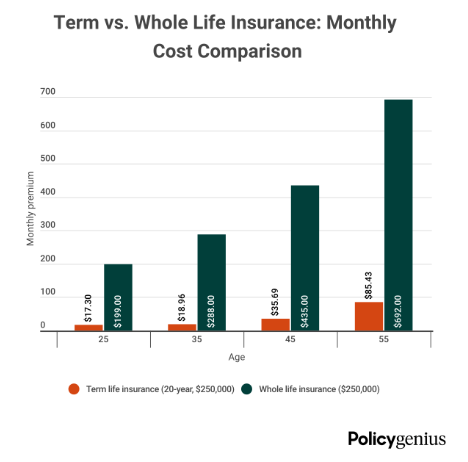

The way we can make these two life insurance policies distinctive is that term life insurance gives the benefits and coverage from 10-30 years while whole life insurance provides protection throughout your whole life since it’s unlimited. Whole life insurance is definitely more complex than term life insurance due to the fact that there’s no cash value in it.

“Decide which kind of life insurance fits your needs the most in the current situation you are in. If you believe that someone in your life or yourself is in a dire situation such as a life threatening disease, etc., then term life insurance is the best choice for you. If you just need it for long-term protection and benefits, then whole life insurance is an excellent decision for you

There are many advantages and disadvantages for term life insurance but the main advantage to point out is that your beneficiaries such as your family and children will get a much higher benefit when you pass away. The main disadvantage is that you must renew/buy the term life insurance again once it expires.

“A big benefit you can get from whole life insurance is that you’ll always get a death benefit for your family and children but one of the main losses would be how highly priced the life insurance is.