Frequently asked questions

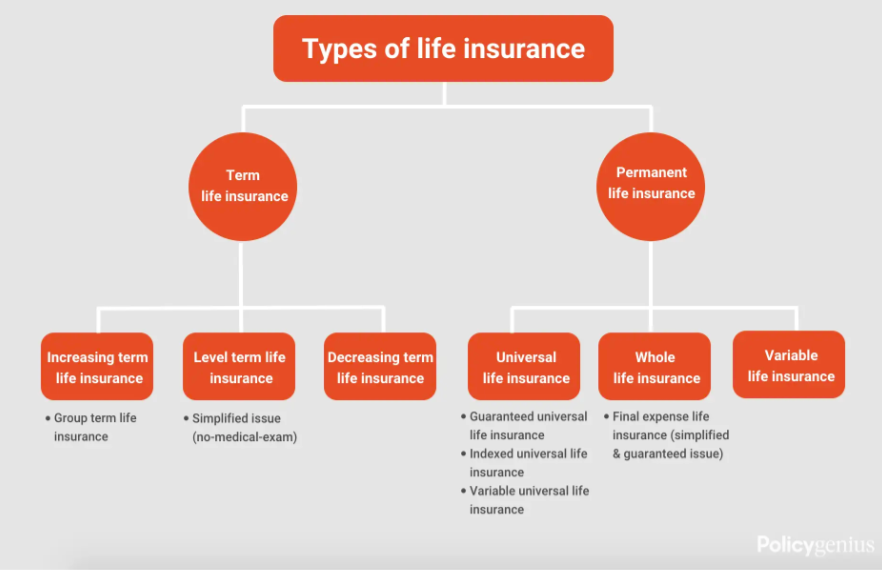

Term life insurance is one of the components of life insurance where you pay in a specific amount of years in order to cover costs for death and such. On the other hand, permanent life insurance is a life insurance you pay for the rest of your life unless you don’t have enough to pay the premiums anymore. It also covers costs of death and such.

TBA to save or invest. But because cash value policies have more expensive premiums, limited investment options, and offer relatively low rates of return, they’re not a great primary savings vehicle.

What type of life insurance you should buy depends on what your needs and requirements are. If you are considering having life insurance for a lifetime just to get protection forever, then you should probably choose permanent life insurance. If you just need it for a certain amount of time, then term life insurance is a great choice for you.

The reason why term life insurance is very popular to get is because you get to choose how long you want the life insurance to start and end. Another purpose for term life insurance is that it’s cheaper to get since you can choose options where the shorter the year, the cheaper it will be compared to permanent life insurance